Bwin.party Still Interesting to Amaya and William Hill, As Rumors Escalate

Both Amaya and William Hill are rumored to be interested in purchasing online gambling giant bwin.party. (Image: pokerupdate.com)

Bwin.party hasn’t had any luck finding a buyer just yet, but that doesn’t mean that there won’t be a sale at some point.

While reports last week suggested that such talks were off, new rumors are now circulating that there are still a couple of major gaming companies that would be happy to take over bwin.party at the right price.

According to a report by the London Evening Standard, the Canada-based Amaya Gaming Group is still at the table, negotiating for a potential acquisition of the European online gambling giant. The news came just days after bwin.party’s stock price plummeted late last week, losing 20 percent on news that talks were off with potential buyers.

Bwin.party quickly tried to push back against those reports, saying that it would be “obligated to update the market” if the company were really done talking to potential buyers, and that it had nothing to report on that subject as of yet.

While that didn’t immediately calm investors, it does seem as though the markets now believe there could still be a sale in the offing.

Amaya Could Seek bwin.party for Sports Betting Op

The first likely suspect is Amaya, which has always been seen as a potential buyer.

If the Montreal-based company were to acquire bwin.party, it would immediately gain access to a very large sports betting operation, an area of online gambling where its operations lag behind many of the other major players in the industry.

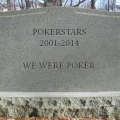

It would be harder for the company to integrate partypoker into a firm that already operates PokerStars and Full Tilt, but adding yet another large poker room to the Amaya stable wouldn’t hurt the company, either.

However, there’s a second potential buyer that only emerged in rumors over the past weekend.

That would be William Hill, the British bookmaker that has been aggressively pursuing opportunities to expand its Internet gambling footprint. Last week, William Hill made an offer to purchase 888 Holdings, the company that operates 888poker and other online gambling products. However, that offer was rebuffed.

“Due to a significant difference of opinion on value with a key stakeholder, it has not been possible to reach agreement on the terms of a possible offer and the board of the company has agreed with William Hill to terminate discussions,” 888 said in a statement.

It is widely believed that the holdout was the Shaked family, one of the Israeli founders of 888. While William Hill was said to be offering a premium price of about £2 ($3.09) per share, reports said that the Shakeds wanted closed to £3 ($4.63) per share, a price William Hill couldn’t justify.

William Hill Looking for Second Option After Failed 888 Purchase

With that acquisition off the table, it’s natural to wonder if William Hill will now look elsewhere for opportunities to buy a major online gambling firm.

Were the bookmaker to take over bwin.party, it would not only gain very successful online poker and casino products, but might also be able to integrate bwin’s online sports betting client base into its business.

Of course, with no confirmation from any of these parties, all of these talks of potential buyouts remain little more than rumors. However, they’ve proven beneficial to bwin.party: the company’s stock price rebounded about four percent on Tuesday on the news that talks were ongoing.

0 Comments